kern county property tax payment

Search for your property. Correspondence must include the Assessor Tax Number and be mailed to.

Kern County Treasurer And Tax Collector

The owner search is the best way to find a property.

. Select the property VIEW DETAILS link. Fraud Waste and Abuse in Kern County Government. The Kern County California online Tax-Defaulted Property Sale will take place March 14-March 16.

Deposits are no longer being accepted. Kern County Treasurer-Tax Collector. Payments can be made on this website or mailed to our payment processing center at PO.

This website is for your. Child Abuse or Neglect. Property Taxes - Pay Online.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. The 500000 deposit will be refunded by Grant Street Group within ten 10 business days after the sale to all unsuccessful bidders. The first round of property taxes is due by 5 pm.

Property Taxes - Pay Online. Visa MasterCard American Express or Discover cards can be used for payments made online. In order to process payments using this website you must read and agree to the following terms and conditions.

For tax-defaulted bills visit Treasurer-Tax Collector Redemption Installment Plans for the form to establish a tax-defaulted installment plan with the Kern County Treasurer Tax Collector. The Kern County California online Tax-Defaulted Property Sale will take place March 14-March 16. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

The median property tax on a 21710000 house is 227955 in the United States. Last day to pay unsecured taxes without penalty. Thereon is taken from the assessment roll.

Deposits are no longer being accepted. Tax payments only must be mailed to. Los Angeles County California sales tax rate details The minimum combined 2021 sales tax rate for Los Angeles County California is 1025.

Last day to request a Proposition 8 decline in value review of the assessment on the current tax bill. Payment within five 5 business days to the Kern County Treasurer-Tax Collector you will forfeit your deposit. Unsecured personal property tax.

The Kern County treasurer and tax collector is warning people not to be late otherwise a. - Kern County Treasurer and Tax Collector Jordan Kaufman announces that the deadline for payment of unsecured property taxes is August 31st. Child Abuse or Neglect.

The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Start by looking up your property or refer to your tax statement. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The median property tax on a 21710000 house is 173680 in Kern County. Payments can be made online at kcttccokerncaus. Last day to file property tax exemptions.

Crime Non-Emergency Domestic Violence. 24-HOUR INFORMATION AND PAYMENT SYSTEM. Kerr County Tax Office Phone.

Box 541004 Los Angeles CA 90054-1004 Countdown to Deadline An Important Message for Owners of Secured Property. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Box 541004 Los Angeles CA 90054-1004.

Questions pertaining to collection of current and delinquent taxes should be directed to the Treasurer-Tax Collector at 661 868-3490. You can view the list of items for sale by visiting 03142022 Tax Sale or by clicking on the sales listed in the auction calendar. Secured tax bills are paid in two installments.

The deadline was 500 PM Pacific Time on March 4. On-line Tax Payment Terms and Conditions. Property Taxes - Pay by Wire.

Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. The median property tax on a 21710000 house is 160654 in California. A 10 penalty is.

You can view the list of items for sale by visiting 03142022 Tax Sale or by clicking on the sales listed in the auction calendar. The deadline was 500 PM Pacific Time on March 4. Crime Non-Emergency Domestic Violence.

Request Refund of Court Reporter Fees. Do not include correspondence with your payment. Taxpayer Service Center PO.

There is no provision to make more than two installment payments on your current secured taxes and one installment on your current unsecured taxes. What is LA county tax rate. See detailed property tax information from the sample report for 10804 Thunder Falls Ave Kern County CA.

Press enter or click to play code. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. Join Courts Press Mailing List.

The first installment is due on 1st November with a payment deadline on 10th December. Box 579 Bakersfield CA 93302-0580. Please type the text from the image.

Fraud Waste and Abuse in Kern County Government. Kern County CA Home Menu. Automated property tax information is available 24 hours a day by telephone at.

Look up your property here 2. Kern County collects on average 08 of a propertys assessed fair market value as property tax. The descriptions provided are based on the official records of the Kern County - Assessor.

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Property Taxes Due Next Week Kget 17

Home Water Association Of Kern County

Kern County Treasurer And Tax Collector

Kern County Taxpayers Association 82nd Annual Meeting Kern County Taxpayers Association

Kern County Treasurer And Tax Collector

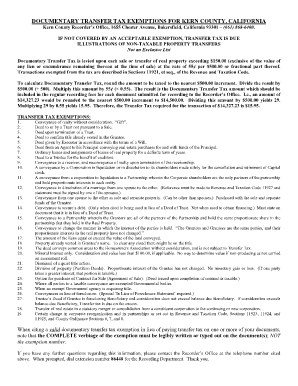

Kern County Assessor Forms Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Grant Deed Kern County Fill Online Printable Fillable Blank Pdffiller

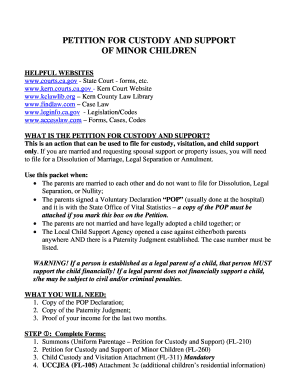

Kern County Court Forms Fill Online Printable Fillable Blank Pdffiller

Kern County Treasurer And Tax Collector

Kern County California Fha Va And Usda Loan Information

Jordan Kaufman Kern County Treasurer Tax Collector

Kern County Treasurer And Tax Collector

Kern County Taxpayers Association Kern County Taxpayers Association

Jordan Kaufman Kern County Treasurer Tax Collector

Oil Gas Play Key Role For Kern County Public Finances Energy Duke Edu